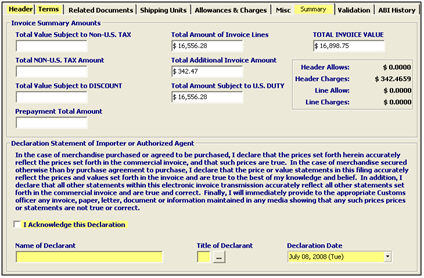

You should review your values using the Summary tab. Compare these displayed amounts to those found on the invoice and CF-7501 for accuracy

|

Field/Button |

Status |

Description |

|

Total Value Subject to Non-US Tax |

Displayed |

Displays the total portion of the invoice value (in US dollars) that is subject to a foreign tax. |

|

Total Non-US Tax |

Displayed |

Displays the total amount of foreign tax payable to the supplier. |

|

Total Value Subject to Discount |

Displayed |

Displays the total portion of the invoice value (in US dollars) that is subject to a payment discount. |

|

Prepayment Amt. |

Displayed |

Displays the total US dollar amount prepaid and unaccounted for on the invoice. |

|

Total Amount of Invoice Lines |

Displayed |

Displays the total of the invoice line monetary amounts, including all invoice allowances or charges offered at the invoice line level. |

|

Total Additional Invoice Amount |

Displayed |

Displays the net US dollar total of any invoice allowances and charges that are reported at the invoice header level. |

|

Total Amt. Subject to US Duty |

Displayed |

Displays the total invoice amount (in US dollars) that is subject to US duty. |

|

Total Invoice Value |

Displayed |

Displays the total US dollar value of the invoice. |

|

I Acknowledge this Declaration |

Mandatory |

Check this box to indicate that you (the declarant) acknowledge the preceding declaration. |

|

Name/Title/Date of Declaration |

Mandatory |

Enter the name of the person authorized to declare the veracity of the invoiced data. Enter the declarant’s title, or choose from the pick-list by clicking the ellipsis. You must also date this declaration, or select from the calendar by clicking on the drop-down. |

After completing the Summary Tab, move on to the Validation Tab.