Click the Tariff Picker link, under Reference on the Main Page:

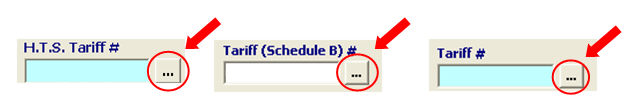

You can also access the tariff picker by clicking the

button,

located next to any field

where you would enter a tariff number. (Entry Line Screen, AII Line Screen,

etc.)

button,

located next to any field

where you would enter a tariff number. (Entry Line Screen, AII Line Screen,

etc.)

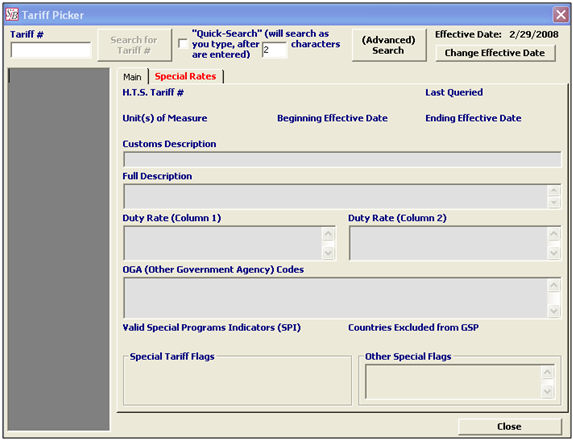

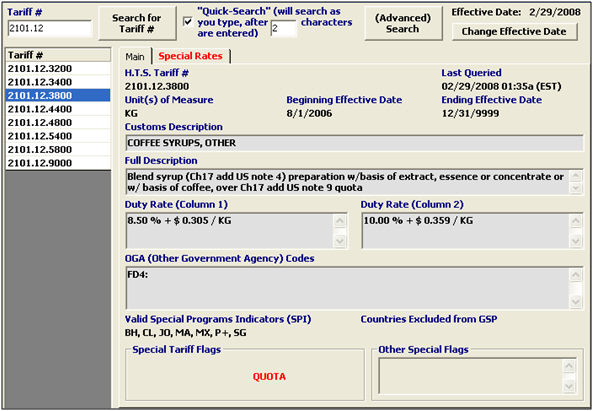

Please consult the screenshots below and the tables on the following page if you are uncertain of the meaning/purpose of a data or information field. This is the information that will display, based on the tariff search criteria. The screenshots below show examples of a tariff classification that has most of these fields in use. The first screenshot shows the Main information fields, and the second shows the Special Rates screen.

|

Field (Main tab) |

Description |

|

HTS Tariff # |

Displays the 10 digit HTS number that is currently selected or highlighted. The results displayed are for this specific HTS. |

|

Unit(s) of Measure |

The unit of measure that is required by Customs to be reported when using the selected tariff classification |

|

Last Queried |

The last time the system queried the selected HTS against the record in Customs system. This is automatic, and done nightly. |

|

Beginning Effective Date |

The date that the tariff # became/is becoming effective. |

|

Ending Effective Date |

The date that the tariff # is no longer valid |

|

Customs Description |

The Customs description of the products. This is also sometimes referred to as the ”r;short description” |

|

Full Description |

This is the full description of the HTS classification selected |

|

Duty Rate (Column 1) |

The duty rate applicable in column 1 of the HTS. |

|

Duty Rate (Column 2) |

The duty rate applicable in column 2 of the HTS. |

|

OGA (Other Government Agency) Codes |

This will display the OGA codes, when the selected tariff has been flagged for OGA required (or may be required): These include FDA(Food and Drug), FCC(Federal Communication), DOT(Dept. of Transportation), FWS (Fish and Wildlife), etc. |

|

Valid Special Programs Indicators (SPI) |

A listing of the program indicators for countries that have an agreement with the United States for preferential treatment |

|

Countries Excluded from GSP |

A listing of the countries that are excluded from the Generalized System of Preferences (GSP) |

|

Special Tariff Flags |

Any special requirements that may be applicable for the selected tariff. These include quota, ADD/CVD, additional HTS required, Textile category #, etc. |

|

Other Special Flags |

Any other special flags for the selected tariff will display here. These include F250 (Formal entry required if value over $250) and FALW (Formal entry always required) |

|

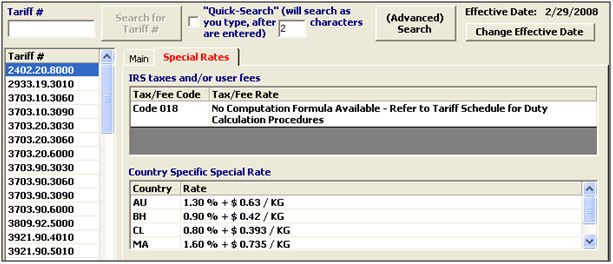

Field (Special Rates Tab) |

Description |

|

IRS Taxes and/or User Fees |

IRS taxes or other user fees, to be applied to this tariff, will be listed here |

|

Country Specific Special Rate |

If a special rate of duty applies to a particular country it will be listed here |

Now that you're familiar with the basics of the Tariff Picker, you're ready to begin using this valuable tool:

Create a Basic Search

Create an Advanced Search